Category: ESG

-

What do the ESRS mean for your business and how can you prepare for them?

The ESRS means that your business will need to prepare and publish a comprehensive sustainability statement that covers both financial and impact materiality aspects of your ESG performance. This will require you to: • Conduct a materiality assessment to identify the ESG topics that are relevant for your business and your stakeholders • Collect and…

-

About the European Sustainability Reporting Standards (ESRS)

What are the European Sustainability Reporting Standards and why do they matter? If you are a company operating in the European Union, you may have heard of the new European Sustainability Reporting Standards (ESRS) that were adopted by the European Commission on July 31, 2023. These standards are part of the EU’s ambitious agenda to…

-

How to Reduce Scope 3 Emissions

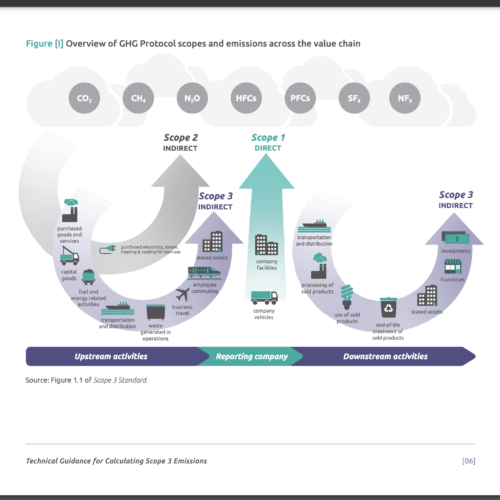

Scope 3 emissions are indirect emissions that occur in the value chain of a business, both upstream and downstream. Therefore, reducing scope 3 emissions can have an impact on a business’s GHG footprint and stakeholder relationships. Some of the strategies to reduce Scope 3 emissions include: • Engaging with suppliers: One of the sources of…

-

How to Reduce Scope 2 Emissions

Scope 2 emissions are indirect emissions from purchased electricity. Reducing scope 2 emissions can have a positive impact on a business’s GHG footprint and energy costs. Some of the strategies to reduce Scope 2 emissions are: • Purchasing renewable energy: Buying electricity, heat, steam, or cooling from renewable sources can reduce the GHG intensity of…

-

How to Reduce Scope 1 Emissions

Scope 1 emissions are direct emissions from business operations and include emissions from the combustion of fuels in stationary equipment, such as boilers, furnaces, turbines, or heaters; emissions from the combustion of fuels in mobile sources, such as cars, trucks, buses, motorcycles, airplanes, or ships; emissions from intentional or unintentional releases of gases, such as…

-

GHG Accounting and Reporting: Scope 1, 2 and 3 Emissions

As the world grapples with the urgent need to combat climate change, greenhouse gas (GHG) emissions have emerged as a critical focal point. Beyond the environmental implications, GHG emissions are inextricably linked to Environmental, Social, and Governance (ESG) reporting, which has gained immense prominence in recent years especially in the corporate world. Companies worldwide are…

-

Measuring Companies ESG Perfomance

ESG stands for environmental, social, and governance, and it refers to the criteria that measure the sustainability and ethical impact of a company or organization. ESG performance is increasingly important for investors, customers, employees, regulators, and other stakeholders who want to align their values with their economic decisions. Measuring ESG performance can help companies and…

-

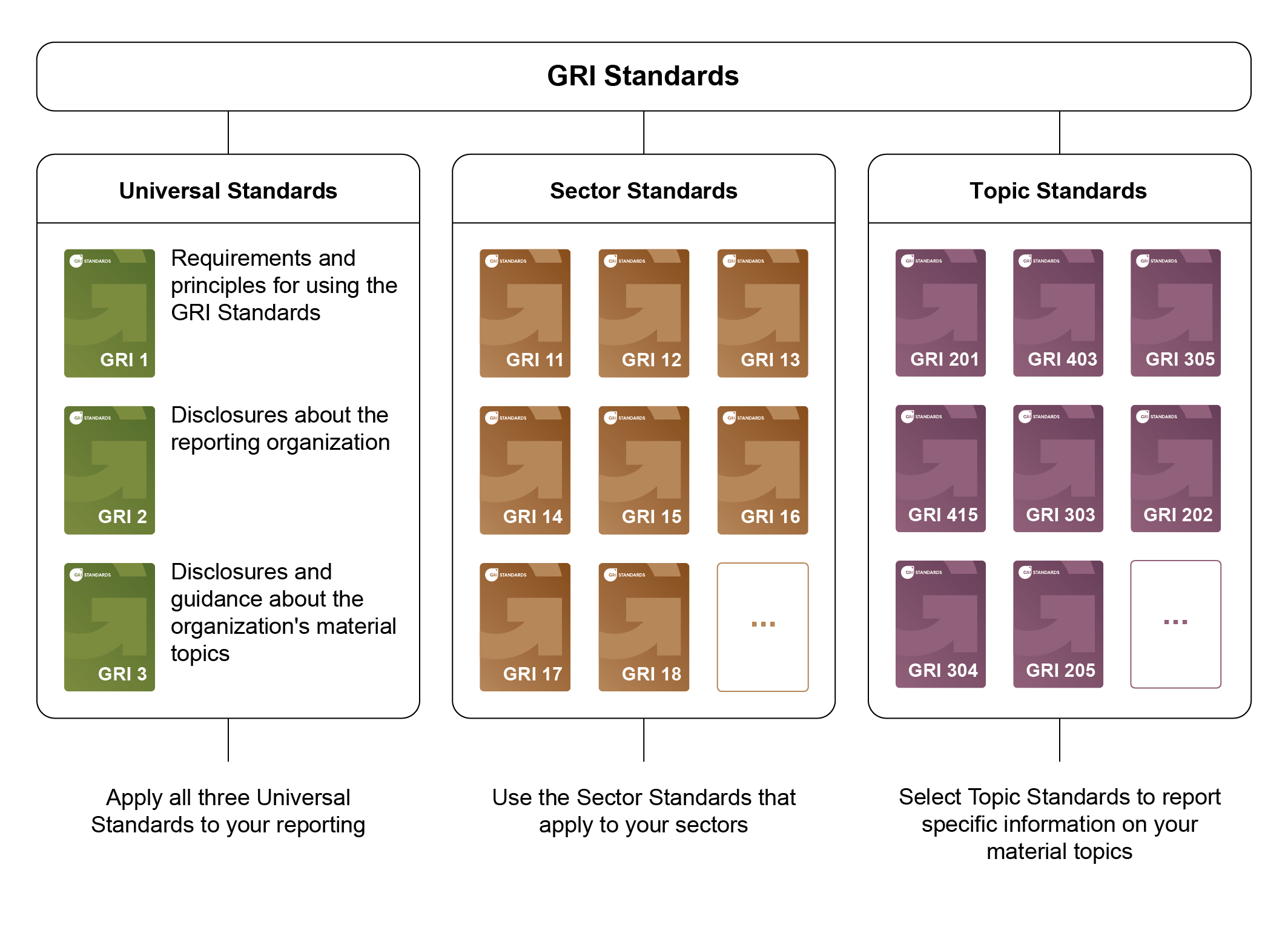

About The Global Reporting Initiative (GRI)

The Global Reporting Initiative (GRI) standards are a set of global standards for sustainability reporting that help organizations understand and communicate their impacts and contributions on the Environment, Social, and Governance (ESG) in a consistent and comparable way. The GRI standards are the most widely used sustainability reporting standards in the world as they can…

-

ESG Reporting Frameworks: What They Are and How to Choose Them

ESG stands for environmental, social, and governance, and it refers to a set of criteria that measure how a company performs in relation to the planet and its people. ESG reporting is the process of disclosing information on the ESG performance and impact of a company to its stakeholders, such as investors, customers, employees, regulators,…

-

How to Conduct a Materiality Assessment

There is no one-size-fits-all approach to conducting a materiality assessment. In this blog, I will give you some of the common steps that you can follow to conduct a materiality assessment effectively and efficiently: • Define the scope and objectives of your materiality assessment. For example, what are the main drivers and purposes of the…